Six Sigma Business Process

What Is A Six Sigma Business Process?

In simple terms, every Six Sigma business process should have clear process outputs (the deliverables). Every business process has two kinds of customers i.e. Internal customers who are usually the staff and employees, and the external customers, those who actually buy the products and services of the company.

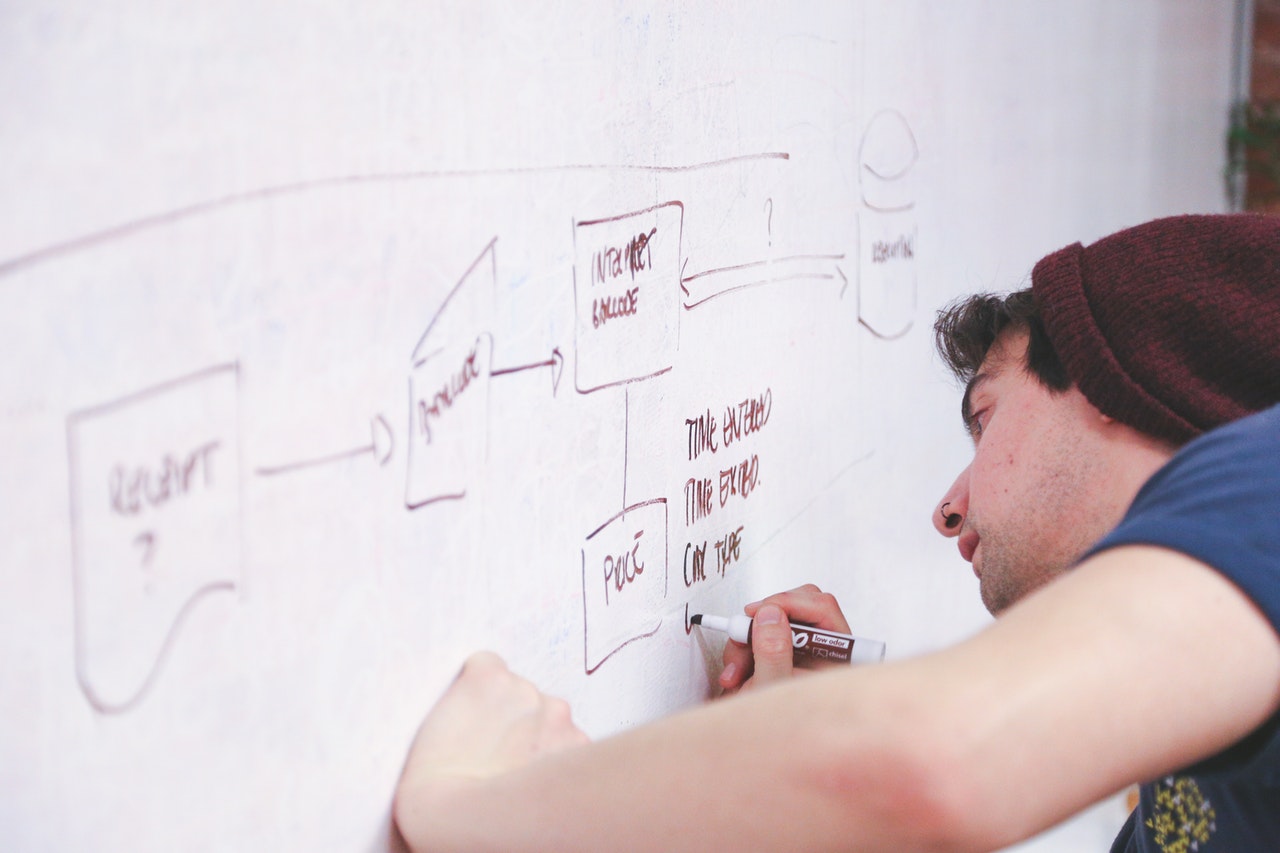

Ay business process that does not specify the end output deliverables, simply is not a Six Sigma business process. On the other hand, the ordinary business process just shows the workflow or process map with no clear end customer outputs. Documenting such business processes, may be equivalent of wasting a lot of time and money. This itself can become a Six Sigma project and can help save a lot of money by doing the right process mapping. (just a thought). The topic of ‘process mapping techniques’ is slightly a different debate which I may cover separately. Here I will only stick with what Six Sigma business process is and what it can do for your company.

Let’s take an example…

ABC Bank has an Auto loan to approve. The process may

include three staff i.e. the initiator, the loan reviewer/analyst, and the loan

approver with signatures. Now what should be the end output of the ‘Auto Loan Approval’

business process. It should be the ‘signed piece of approval document’ with

reference and date. However, please note that even at this stage the loan amount

may not be in the customer’s account.

Now, if you want the amount in the customer’s account, then you may need to have ‘Auto Loan Disbursement’ process as well. This may also include three staff i.e. the system data entry staff, the system data reviewer, and the disbursement approver in the system. The final output of the process is the ‘snapshot of the money in the customer’s account’ with reference and date.

The time it takes to start the process and end it, is called the cycle time or the lead time. Since every process has either internal customer or external customer, in the first ‘Auto Loan Approval’, it was delivered to the internal customer, the disbursement team leader. Whereas the ‘Auto Loan Disbursement’ process has the external customer, where the money is credited to the customer’s account.

Therefore, it shows that the Auto loan processing has two inbuilt processes, and the second ‘loan disbursement…’ process is entirely dependent upon the first one (loan approval). The effort can also be made to combine and integrate both processes in a lean manner but that will depend from case to case basis based on the complexity of the steps. Normally, it is preferred and advised that if the steps are complex or more in numbers, it is much better to divide it into two or more business processes for ease of understanding, implementing and clarity of outputs.

In case, if the process is already simple, it can easily be mapped in one-go. Another important thing here is that we are still not debating how much time it takes to start and end this process, how many hours and days, customer has to wait. That aspect is the ‘process analysis’ part, we will cover separately.

Here, I just want to keep it simple by providing the simple understanding what Six Sigma business process should be like. Generally speaking, based on my several years of experience with variety of companies, I can easily share that most of the companies in the world even don’t have simple documented workflows or process maps in place. The processes are just done and executed without having any documentation. This is mostly true for the small and medium sized businesses, who are mostly owner-driven and they tend to make decisions on the basis of personal experience, guesses and intuition, of course a completely non-six sigma approach of doing things.

In short, if you really want to get the good start, just adopt the Six Sigma business process method to define and formulate all your business processes with clear outputs and clear deliverables to the end customers whether internal or external.